Lasting Power of Attorney: making sure the people you trust the most, can make decisions that matter the most

In this guest post, Clare Fuller talks about the importance of making a Lasting Power of Attorney. Clare Fuller RGN MSc is a registered nurse with a career dedicated to Palliative and End of Life Care. She is an advocate for proactive Advance Care Planning and delivers bespoke EoLC education. She is also a Lasting Power of Attorney Consultant and director of Speak for Me LPA .

Introduction

My Uncle left school at fourteen training to become an electrician before joining the Royal Navy in 1941. He took part in the Artic Convoy in conditions that would be unimaginable for us today and was rewarded for his heroism 70 years later with the Arctic Cross. He married my Aunt and cared for her at home during a long decline with dementia until her death. Throughout his life my Uncle remained busy and skilled in electrical projects; a person we knew would always fix everything. This changed when began to forget things, and the man who once navigated the Arctic would get lost finding his home.

My Uncle had made a Lasting Power of Attorney for Health and Welfare and Property and Finance. This meant the people he trusted the most could make decisions that mattered the most for him as he became unable to make those decisions himself.

What is a Lasting Power of Attorney?

A Lasting Power of Attorney (LPA) is a legal document that lets you appoint one or more people to make decisions on your behalf. This gives you more control over what happens to you if you have a sudden accident or an illness and cannot make your own decisions. The people you appoint are called attorneys.

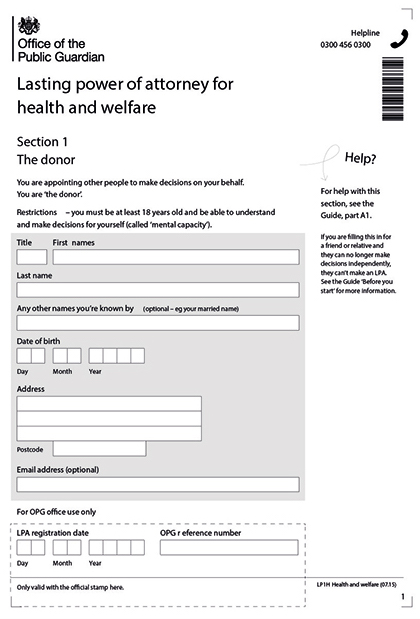

To make a Lasting Power of Attorney you must have the mental capacity to make the decision to appoint your attorneys. The form requires confirmation from a ‘certificate provider’ that you’re making the LPA by choice and that you understand what you are doing.

A Lasting Power of Attorney must be registered with the Office of the Public Guardian before it can be used. Pre COVID-19 this process was estimated to take approximately 8-10 weeks; however, the current waiting time is closer to 14 weeks. Too often people leave it too late to make a Lasting Power of Attorney.

What are the different types of Lasting Power of Attorney?

There are two different kinds of Lasting Power of Attorney, one for Health and Welfare and one for Property and Finance. A Health and Welfare LPA would be used if you lost capacity to make decisions about issues relating to health (e.g. whether you should have surgery or other medical treatments). An important element of the Health and Welfare LPA is that it offers the opportunity to give the person or people appointed, (the attorney(s)), authority to make life-sustaining treatment decisions.

A Property and Finance LPA is used for to appoint someone to make decisions about your money for things like paying bills, collecting pensions or selling your home and can take effect, with your consent, as soon as it is registered.

Why is it important to have a Lasting Power of Attorney?

It is a common misconception that your next of kin can make decisions for you should you lose ability to do this through illness or accident; but the only way to ensure this is through nominating them formally through a Lasting Power of Attorney. A Lasting Power of Attorney ensures that your voice is heard if you should ever lose the ability to make decisions and speak for yourself.

With no automatic right for your Next of Kin to make decisions your family may need to apply to the Court of Protection to be your Deputy if you lose capacity and don’t have a Power of Attorney. Once you have lost capacity, you can no longer choose who will be appointed your Deputy. Applying to the Court of Protection is a lengthy and costly process and can delay important decision making as well as be a significant burden on your family.

There are some excellent blogs on how the Court of Protection works and I have had the privilege of attending two hearings at the Court of Protection Bearing Witness: Anorexia Nervosa and NG Feeding in July 2020 and, more recently, Lasting Power of Attorney: Across Borders These were sobering experiences and interesting to see how decision making is made in court.

Without a Lasting Power of Attorney for Property and Finance, your family potentially will not be able to pay bills, manage your finances, pensions or care home fees. Campaigns show 73% of people think if a couple have a joint bank account and one person can’t make decisions for themselves, their partner can legally make decisions for them both. This is untrue

Without an LPA for Health and Welfare decisions your family will not be able to make decisions about important health matters, for example medical treatment and where you are cared for. 72% of people think your next of kin have the final decision in making treatment decisions in hospital if you are too unwell to make them yourself. This again is not true.

Through nominating someone now to act as you attorney for the future you protect your wishes avoid the possibility of both costly and lengthy Court of Protection costs.

Common misconceptions about Lasting Power of Attorney

Despite a widespread campaign across the UK, Lasting Power of Attorney remains little understood. As well as thinking your Next of Kin have automatic rights to make decisions on your behalf another common misconception is that a Lasting Power of Attorney need only be considered if you have a deteriorating illness or are elderly. Instead of waiting and finding yourself in sudden need, I suggest that Lasting Power of attorney is a bit like an insurance policy, there just in case you ever need it. Unlike an insurance policy though, the Lasting Power of Attorney needs doing only once (unless you chose to change it).

The other common worry I hear is about losing control, with a belief that making a Lasting Power of Attorney means you are giving up control of your life when indeed it is the opposite; making a Lasting Power of Attorney allows you to be in the driving seat and to choose ahead of time who you trust to make decisions – it takes effect only if you lose capacity or, in the case of Property and Finance, if you consent when it is registered.

How do I make a Lasting Power of Attorney?

There are three options to making a Lasting Power of Attorney; a DIY approach, using a solicitor or using a Lasting Power of Attorney Consultant. Like everything, there are pros and cons to each choice and it is worth researching to find out the option that works best for you.

Once a Lasting Power of Attorney is drafted it must be signed strictly in the correct order by the appropriate people – there are restrictions on who can witness and be a certificate provider for example. It is then sent to the Office of the Public Guardian where the forms are checked, reviewed and processed which takes around 15 weeks. There is a fee of to be paid to the Office of the Public Guardian which is currently £82.00, however in some cases there are remissions or exemptions.

If there are any errors on the forms they will be rejected and you may need to pay the full £82.00 to re-apply. Data from the Office of the Public Guardian states about 15% of forms are rejected.

It is important to compare the options and ensure you chose the option most suited to your needs.

Three options

The DIY option involves using the GOV.UK site to make the forms. You will need to ensure information is correct, within legal boundaries and that the signatory process is completed in the correct order. This will cost you the registration fee of £82.00 per Lasting Power of Attorney.

*Completing independently is the most cost-effective option, however many people are put off by the potentially lengthy forms. Errors in completion, signing and rejection might be more likely to occur than the other options.

The Lasting Power of Attorney Consultant option involves engaging an independent consultant drafting the documentation after a discussion with you. You will need to pay the Consultant fees in addition to the Office of the Public Guardian fee. Depending on the service offered it will include full liaison with the Office of the Public Guardian in the event of any errors.

*Using an independent provider can ensure peace of mind and an individualised service and, whilst more expensive than a DIY approach, it should cost less than a solicitor.

The solicitor option involves engaging a solicitor to draft the lasting Power of Attorney documentation. Again, you will need to pay solicitor fees on top of the Office of the Public Guardian fee.

Using a solicitor will be a preferred option for some particularly if there are complex financial issues.

Questions to ask if engaging a LPA Consultant or Solicitor

- What is included in the cost, particularly:

- The Office of the Public Guardian fee

- Any Consultation with the Office of the Public Guardian if needed

- Provision of a Certificate Provider

- Provision of a Witness

- Re-application in the case of rejection

- Can a Face to face or remote service be offered?

- How long does it take for the consultation and drafting?

- How many consultations are included?

Can I complete my LPA on MyWishes?

No you cannot complete LPAs on MyWishes. LPAs need to be completed offline using a document created by the UK Government or on the Gov.uk website. We do however link through to the relevant documents within the advance care planning feature in the MyWishes application.

Once the LPAs process has been completed, we recommend that you share a copy of the document with someone you trust and discuss your LPA wishes.

MyWishes free to use software was developed under the guidance of healthcare, hospice, legal and funeral professionals. Our platforms empowers society to make plans for both themselves and those they care about.

Other tutorials that you might find of value

Michael Sobell Hospice Palliative Care Department Mount Vernon Hospital, Gate 3 Northwood HA6 2RN United Kingdom (Map)

- Register and document your wishes for free here

- For all enquires click here

- To learn how MyWishes works click here

Sharing is caring…

If you liked this article please feel free to share it using your preferred social network or communication platform